Tokenizing Real-World Assets: What You Need to Know About RWA

- Technology

Aug 23, 2024

RWA.Media

Tokenization first emerged in the realm of blockchain technology and cryptocurrencies, introducing a new way to represent real-world assets or rights through digital tokens. This concept began gaining traction with the development of blockchain technology in the early 2010s.

The earliest notable example of blockchain technology is linked to the launch of Bitcoin in 2009. Bitcoin itself acts as a form of digital token, representing a unit of value on the blockchain. However, the specific idea of tokenizing real-world assets—such as real estate, art, or shares—took shape later.

The first significant tokenized project was "Mastercoin," which began development in 2013. Mastercoin (now known as Omni Layer) is a platform built on the Bitcoin blockchain, introducing the concept of issuing tokens on a blockchain to represent various assets and utilities.

Another notable early project was Ethereum, launched in 2015 by Vitalik Buterin and others. Ethereum's introduction of smart contracts enabled more sophisticated tokenization of assets. One of the first widely recognized tokenization projects on Ethereum was the "DAO" (Decentralized Autonomous Organization) in 2016, which aimed to create a venture capital fund with token-based governance.

The Rise of Tokenized Real-World Assets (RWA)

In 2020, MakerDAO began accepting tokenized real world assets (RWA) like government securities and corporate bonds as collateral for its DAI stablecoin. By the end of 2022, reports from Binance Labs, Coinbase, PwC, and other experts highlighted RWAs as one of the most promising long-term trends in the blockchain industry.

A Coinbase report for 2024 observed a surge in new entrants on public permissionless networks offering direct access to tokenized US Treasury exposure on-chain. The total assets in tokenized US Treasury-like products grew sixfold, surpassing $786 million as digitally native users sought yields separate from traditional crypto sources. Looking ahead to 2024, tokenization is expected to extend to additional market instruments, including equities, private market funds, insurance, and carbon credits, driven by client demand for higher yields and diversified returns.

As of August 2024, according to DeFiLlama, the RWA ecosystem comprises at least 63 protocols and ranks eighth in terms of Total Value Locked (TVL) in smart contracts, with a total amount of $6.42 billion. The total amount of tokenized private credit stands at $8.85 billion.

What is RWA?

RWA (Real World Assets) are tokenized assets originating from the physical world. Their creation involves issuing tokens that track both tangible and intangible assets, with their value and other metrics determined by off-chain sources.

An example of an RWA is the Ondo Short-Term US Government Bond Fund (OUSG). This ERC-20 token is backed by short-term US Treasury bonds, specifically shares of the iShares Short Treasury Bond ETF, which holds these securities.

The infrastructure for tokenizing and trading RWAs is supported by numerous blockchain platforms. According to DeFiLlama, this sector includes 63 protocols with a combined TVL of $6.42 billion.

Tokenization allows traditional assets to be integrated into the DeFi infrastructure, enhancing their accessibility and trading efficiency through the use of automated market makers and other blockchain solutions. RWAs act as a bridge between TradFi (Traditional Finance) and DeFi, potentially transforming the cryptocurrency landscape by providing new sources of capital, liquidity, and yield.

Main Categories of RWAs

Theoretically, any asset that can be formalized and encoded can be tokenized, including both tangible and intangible assets. The assets most suited for tokenization are:

In practice, regulatory requirements and the nature of assets mean that some are easier to tokenize and widely used, while others are more complex. For example, the crypto market has been using US dollar-based RWAs for eight years, represented by USDT tokens and other fiat-backed stablecoins. In contrast, tokenized stocks only appeared in 2018.

However, advancements in blockchain technology and market interest in new asset classes have led to the popularity of the following RWAs in 2024:

Stocks and government bonds

Real estate

Credit obligations

Collectibles

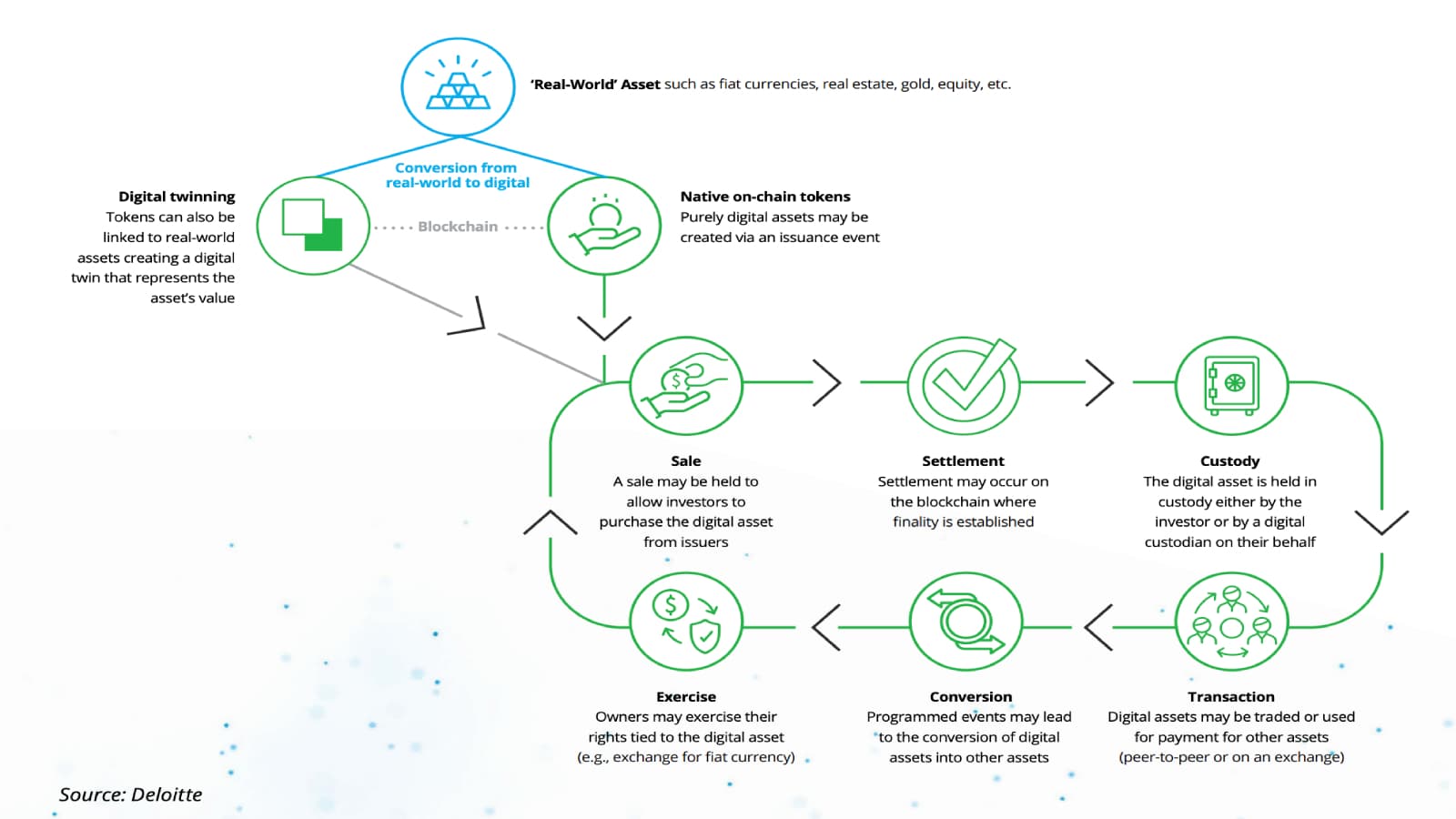

How Does Tokenization Work?

1. Off-Chain Formalization: This involves registering property rights and fixing the economic value of the asset. The asset must receive an appraisal, be registered according to regulatory requirements, and be owned by the originator of the RWA issue.

Example: To tokenize a real estate object, an entrepreneur creates a legal entity. The company buys, say, a hotel, and then issues a number of shares based on the property's monetary value. Each share reflects the right to a portion of the hotel's ownership.

2. Transfer of Information: Once the asset is formalized in the "real" world, its parameters must be transferred to the blockchain using smart contracts and tokens. Developers create a smart contract that contains information about the real-world asset, often entrusting the information transfer process to a third party.

Example: A hotel-owning company contacts a tokenization platform, provides necessary documents, and the platform developers create the smart contract and issue tokens corresponding to the number of shares in the enterprise.

3. Development and Maintenance of RWAs: This stage involves maintaining up-to-date information about the tokenized asset, ensuring liquidity, and providing the technical infrastructure for trading and redeeming RWAs. The tokenization platform typically handles these functions, making necessary adjustments to the smart contract and regulating token circulation.

Why is Tokenization Gaining Momentum?

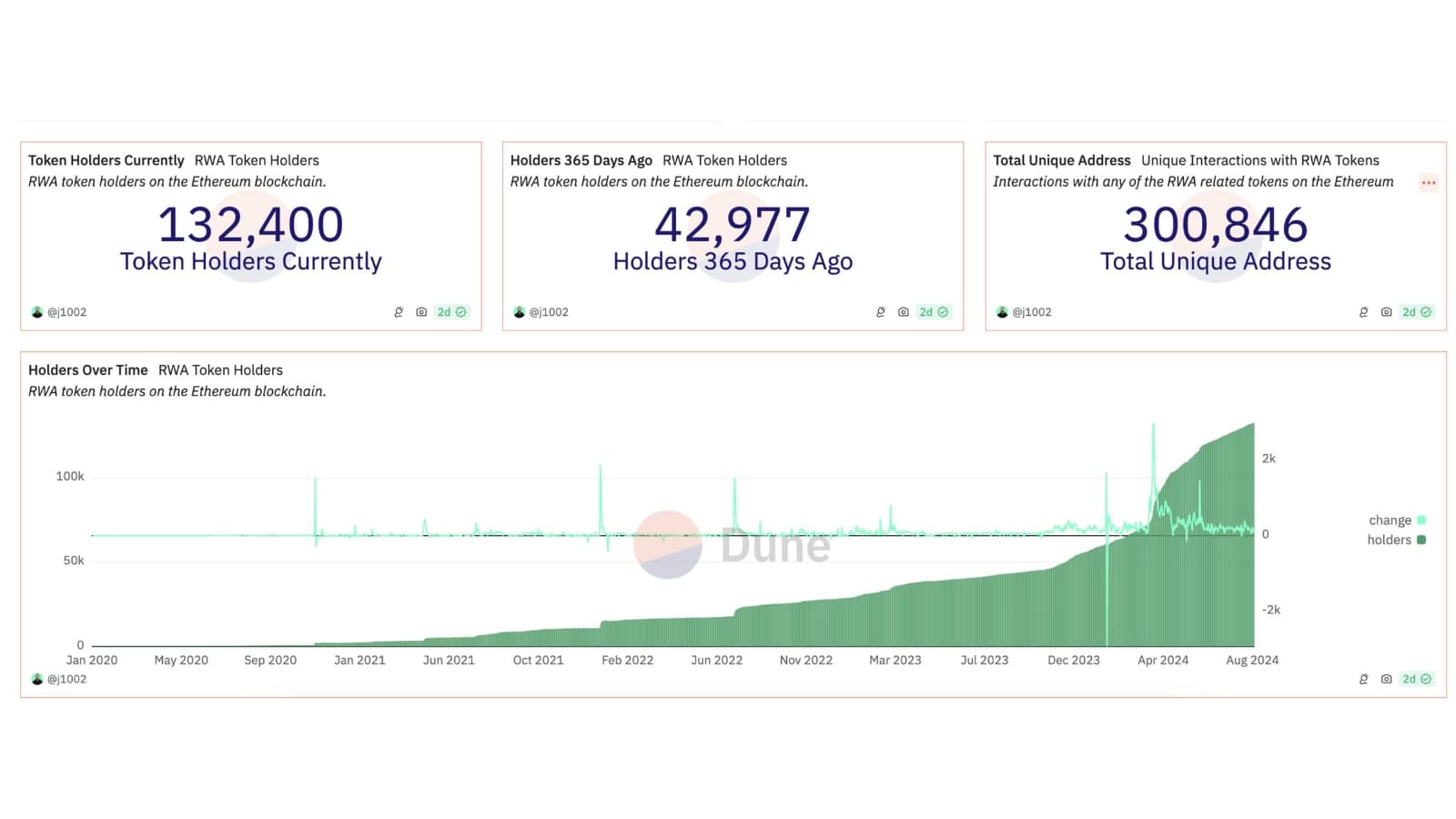

The potential for tokenizing real-world assets has been a focus since the early days of blockchain. Although the first RWAs appeared back in 2018, it was only in the second half of 2022 that the segment began to be recognized as a promising and long-term market trend. The number of token holders in RWA projects.

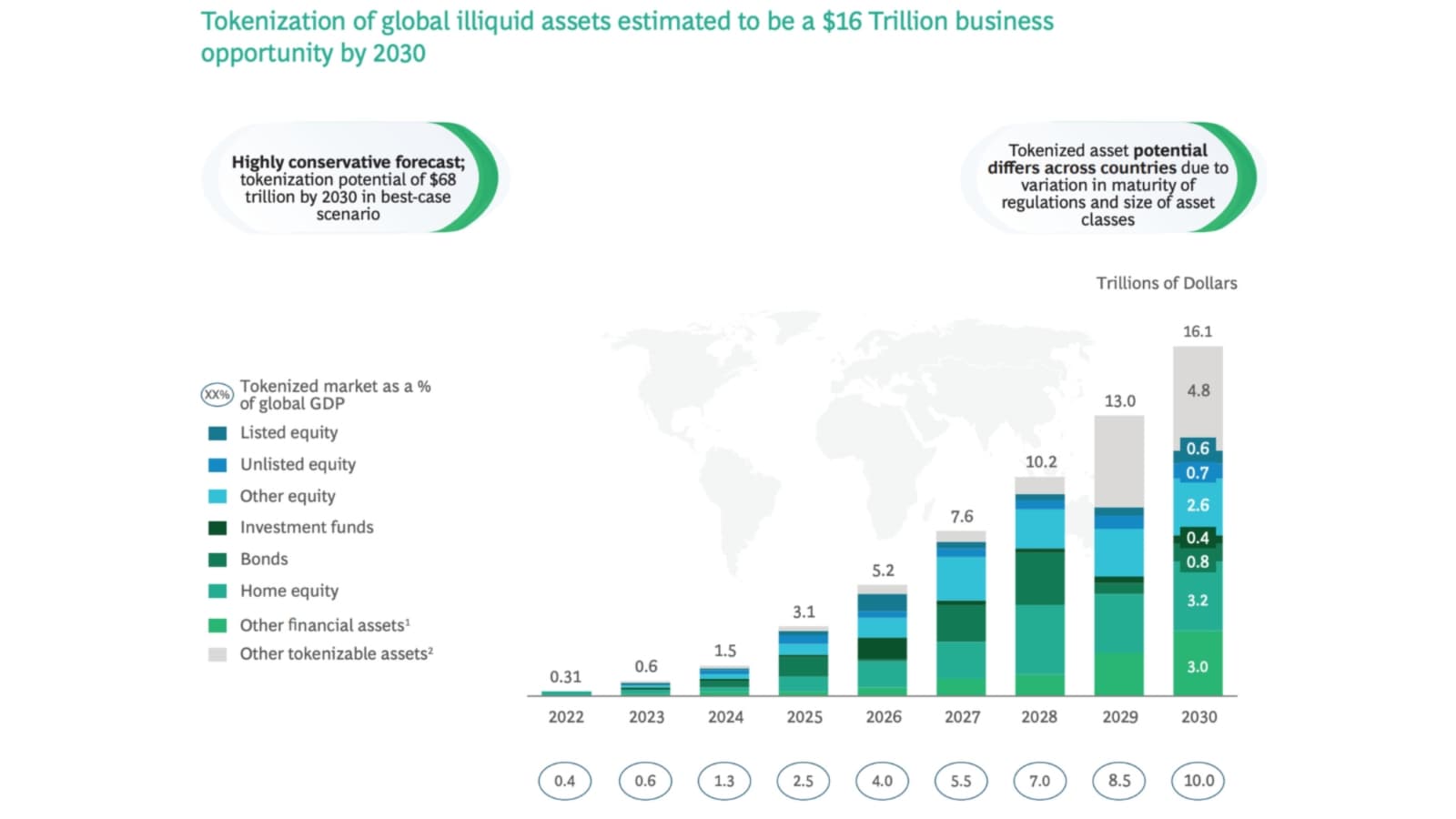

Boston Consulting Group indicates that by 2030, the total capitalization of RWAs could rise to $16 trillion, encompassing stocks, government bonds, real estate, and assets from investment funds.

Tokenization is gaining momentum due to several factors:

Institutional Investment: The involvement of major financial institutions like BlackRock in tokenization is significant, validating the technology and opening doors for wider adoption.

Technological Advancements: Innovations in blockchain technology enhance the feasibility and appeal of tokenization, making it more attractive for various applications beyond just cryptocurrencies.

Regulatory Developments: Increasing clarity and favorable regulations around digital assets contribute to the growing acceptance of tokenization.

Demand for Liquidity: Tokenization allows for fractional ownership of assets, increasing liquidity and accessibility.

Diversification of Assets: Tokenization expands the types of assets that can be traded, attracting investors seeking new opportunities.

Crypto Globalization: Tokenization is becoming popular due to the growth of the crypto industry, which increases legitimacy and creates demand for a wider range of assets.

Larry Fink stated, "In the future, every asset will be tokenized," during a panel discussion at the Bloomberg Wealth Summit in September 2022, emphasizing the potential of blockchain technology in financial markets.

The development of RWAs is further supported by the increasing adoption of blockchain technology in the banking and financial sectors. In August 2023 alone, SWIFT tested the transfer of tokenized assets between blockchains, Visa developed a solution for paying on-chain fees in fiat, and PayPal launched a stablecoin.

The Evolution of Tokenization (2023-2024)

Q1 2023:

Goldman Sachs launches the GS DAP platform, marking significant institutional engagement in tokenization.

The Monetary Authority of Singapore (MAS) initiates Project Guardian, trialing tokenization with other banks and the BIS.

Centrifuge Prime provides legal frameworks for DAOs to invest in RWAs.

MakerDAO opens a $1.28B vault for investing in US Treasury bonds.

Siemens issues a $64M digital bond on Polygon, showcasing tokenization's potential in corporate finance.

Q2 2023:

Ondo Finance issues a tokenized US government bond fund (OUSG), marking the rise of tokenized Treasuries.

Franklin Templeton launches its OnChain US Government Money Fund on Polygon.

The Canton Network, a consortium including Goldman Sachs and Cboe, is unveiled.

Compound Finance launches the “Superstate” fund on Ethereum, focusing on tokenized short-term government bonds.

Q3 2023:

The Financial Stability Board (FSB) unveils a work plan to explore tokenization projects.

The European Central Bank (ECB) begins exploring wholesale Central Bank Digital Currencies (CBDCs).

Q4 2023:

Mastercard pilots the "Multi-Token Network" experiment for tokenized bank deposits.

The potential for tokenized Sukuk emerges, addressing the needs of Muslim investors within a trillion-dollar market.

Q1 2024:

Institutional Adoption: Large financial institutions like Citi and UBS focus on integrating tokenized products into institutional investment portfolios.

Ethereum-Based Futures: Select exchanges start offering futures trading collateralized by tokenized US Treasuries.

Polymesh and OriginTrail push forward with innovations in RWA tokenization, enhancing trust and scalability across supply chains and financial products.

Q2 2024:

The market for tokenized US Treasuries surpasses $1 billion, reflecting growing investor confidence in tokenized assets as a secure, high-yield investment.

BlackRock intensifies its involvement by backing Securitize, aiming to drive compliant digitization of financial assets globally.

Gold-Backed Stablecoins gain traction, fueled by record-high gold prices and renewed interest in asset-backed digital currencies.

Q3 2024:

Continued Expansion: Further advancements in tokenization technology and regulatory frameworks encourage broader adoption in new regions and industries.

The RWA Ecosystem

The RWA segment landscape includes several categories of projects. Binance identifies the following subgroups:

Infrastructure: Projects providing the technological foundation for asset issuance and compliance. This includes specialized blockchains, technical stacks, and legal support for RWAs.

Asset Providers: Platforms involved in the tokenization of assets and the development of infrastructure for their ongoing maintenance and distribution.

Asset providers are further classified based on the type of RWA and the tools they offer. The major sectors of the market include:

Real Estate: Platforms enable the tokenization and trading of property ownership rights, utilizing both fungible tokens and NFTs.

Lending: Platforms allow users to obtain cryptocurrency loans secured by RWAs or to borrow tokenized assets by providing real-world securities as collateral.

Examples: Maple, Goldfinch, Centrifuge.

Tokenized Public Debt: Platforms provide access to government bonds on the blockchain, allowing users to trade or hold RWAs tied to these securities.

These are just the most capitalized classes of RWAs. The broader ecosystem also includes sectors such as agriculture, regenerative finance (ReFi), insurance, various types of financial instruments, and some physical assets.

Notable Projects

Stobox is a full-service tokenization platform that enables businesses to tokenize real world assets (RWA) and manage them efficiently through blockchain technology. The platform offers a complete suite of services, including consulting, legal support, and technological solutions, to help companies transition into the digital economy. Stobox specializes in providing Security Token Offering (STO) solutions, enabling businesses to raise capital by issuing digital securities. The company’s ecosystem integrates with various blockchain networks, making it easier for clients to navigate regulatory landscapes and access global investors.

MakerDAO is widely known as a lending protocol that issues loans in the stablecoin DAI, secured by cryptocurrency collateral. In November 2020, the platform integrated tokenized assets as an additional source of collateral. As of September 2023, the total volume of RWAs held by MakerDAO exceeded $2 billion, with these assets making up 14% of DAI's reserves.

What Are the Advantages of Asset Tokenization?

The primary reason for the development of RWA is the integration of traditional and decentralized finance. This one-way integration can bring benefits to both markets:

For the DeFi sector: It gains a new source of capital and yield, along with new asset classes that help mitigate cryptocurrency volatility and hedge associated risks while keeping all operations onchain.

For TradFi: It opens up a new market and enables economic activity within the DeFi space.

Unlocked liquidity creates new earning opportunities. For example, a holder of tokenized Treasury bonds can receive a fixed yield and, in addition, take out a loan in ETH using their RWAs as collateral and invest it in a liquid staking protocol.

Traditional assets gain a new digitalization standard through blockchain and smart contracts, laying the foundation for further development of trading platforms, 24/7 trading, secure data storage, and resolving other issues faced by centralized exchanges and markets.

For potential users, the main advantage of this integration is the increased inclusivity of financial instruments. Blockchain eliminates intermediaries in the trading value chain, and fractionalization lowers the entry barrier in sectors previously inaccessible to retail investors.

Challenges of RWAs

Tokenization and the transition of traditional assets onto the blockchain present several challenges that this emerging market segment must overcome for further expansion. The main challenges include:

Legal Framework:

Lack of international harmonization, i.e. that different countries have different rules for private placements, in most countries it is necessary to obtain a license separately, etc.

There is no certainty regarding advanced DeFi applications of RWA, such as treatment of decentralized lending and AMM pools

Technical Limitations:

Lack of interoperability between different standards, blockchains and protocols, which reduces opportunities for cross-listing, thereby reducing liquidity for RWAs

Insufficient adoption of solutions like account abstraction, which question UX for non-tech savvy users

Underdeveloped Liquidity:

The market faces limited liquidity, with investors gradually allocating funds to Real World Assets beyond private credit and US Treasuries. The level of collaboration among providers to ensure liquidity remains insufficient. However, according to a survey by EY, 55% of investors plan to allocate a portion of their portfolio to RWAs. By 2027, it is expected that 7% to 9% of portfolios will be comprised of RWAs. This indicates that a significant influx of liquidity is likely in the coming years. Therefore, issuers should be prepared to absorb this capital by starting to tokenize their assets now.

As protocols implement solutions to mitigate these risks, the efficiency of tokenization may improve, and the benefits of tokenization will become more tangible with more transparent regulatory requirements and technical compatibility between DeFi and TradFi.

In the End

Tokenization has come a long way since its early days in the blockchain space. From the pioneering projects like Bitcoin and Ethereum to the growing ecosystem of Real World Assets (RWAs), the tokenization of physical and financial assets is revolutionizing traditional finance. The integration of RWAs into the DeFi ecosystem not only broadens the scope of available assets but also offers new opportunities for capital, liquidity, and investment diversification.

As blockchain technology continues to evolve and regulatory clarity improves, the potential for tokenization to reshape global financial markets becomes more apparent. While challenges remain, the future of tokenization looks promising, with significant growth expected across various asset classes, including real estate, government bonds, and commodities. By 2030, the total capitalization of RWAs could reach $16 trillion, transforming the way we interact with financial markets and assets.